Tax incentives faor prefectural taxes

| Ordinance | Covered area | Conditions for coverage | Enterprise tax | Fixed asset tax ※1 | Real estate acquisition tax |

|---|---|---|---|---|---|

| Fukushima Prefectural tax special tax measures | Low population density district(★) | Acquisition of industrial production equipment (5,000,000 yen or more according to the amount of stated capital) |

○3 years ○ Tax exemption |

○3 years ○ Tax exemption |

○ When acquired ○ Tax exemption |

| Areas in which nuclear power generation facilities are located(●) | Factory production facility acquisition cost 27 million yen or more (In all industries except manufacturing, employment increased by more than 15 people) |

○3 years ○ Differential tax |

○3 years ○ Differential tax |

○ When acquired ○ Reduced to 1/10 |

|

| Applicable areas based on the Regional future investment promotion law | Businesses that receives an approval for their "regional economy leading business plan" to create high added value leveraging of regional specialty | - | - | ○ When acquired ○ Tax exemption |

|

| Municipalities eligible for relocation-type tax benefits based on the Local Revitalization Act Municipalities eligible for expansion-type tax benefits |

Businesses that receives an approval for their regional vitality increase region specified business facility preparation plan | (Transfer type only) ○3 years ○ Differential tax |

○3 years ○ Differential tax |

○ When acquired ○ Reduced to 1/10 |

|

| Ordinances related to exemption of prefectural tax in Fukushima Prefecture revitalization industrial clusters | Special industrial concentration zones for reconstruction ※2 | Designated business entities or designated corporations implementing "industrial concentration projects" that contribute to securing employment opportunities in special industrial concentration zones for reconstruction | ○5 years ○ Tax exemption |

○5 years ○ Tax exemption |

○ When acquired ○ Tax exemption |

| Ordinances related to exemption of prefectural tax in Fukushima Prefecture business siting promotion areas and zones with canceled evacuation directives | Business siting promotion areas ※3 | New businesses that have received prefectural approval for regional recovery restoration business implementation plans in zones such as those with canceled evacuation directives | ○5 years ○ Tax exemption |

○5 years ○ Tax exemption |

○ When acquired ○ Tax exemption |

| Areas with canceled evacuation directives,etc. ※3 | Existing businesses that are recognized by the prefecture has having a business location within the zones under evacuated orders as of March 11,2011 | ||||

| Ordinances related to exemption (tax system to counter harmful rumors) from prefectural taxes based on the Fukushima Prefecture plan to promote specified business activities | All areas in Fukushima Prefecture | Companies that have drawn up a plan for a designated business to implement specified business activities and received designation from the governor of Fukushima Prefecture. | ○5 years ○ Tax exemption |

○5 years ○ Tax exemption |

○ When acquired ○ Tax exemption |

| Ordinances regarding exemption (Innovation Tax System) from prefectural taxes based on the Fukushima Prefecture plan to promote creation of new industries, etc. | Zones promoting creation of new industries, etc. ※4 | Companies that have drawn up a plan to implement creation of new industries, etc. and received approval from the governor of Fukushima Prefecture | ○5 years ○ Tax exemption |

○5 years ○ Tax exemption |

○ When acquired ○ Tax exemption |

※1 Preferential taxation measure for fixed asset tax is also determined by an ordinance of each municipality. Please contact taxation department of each municipality.

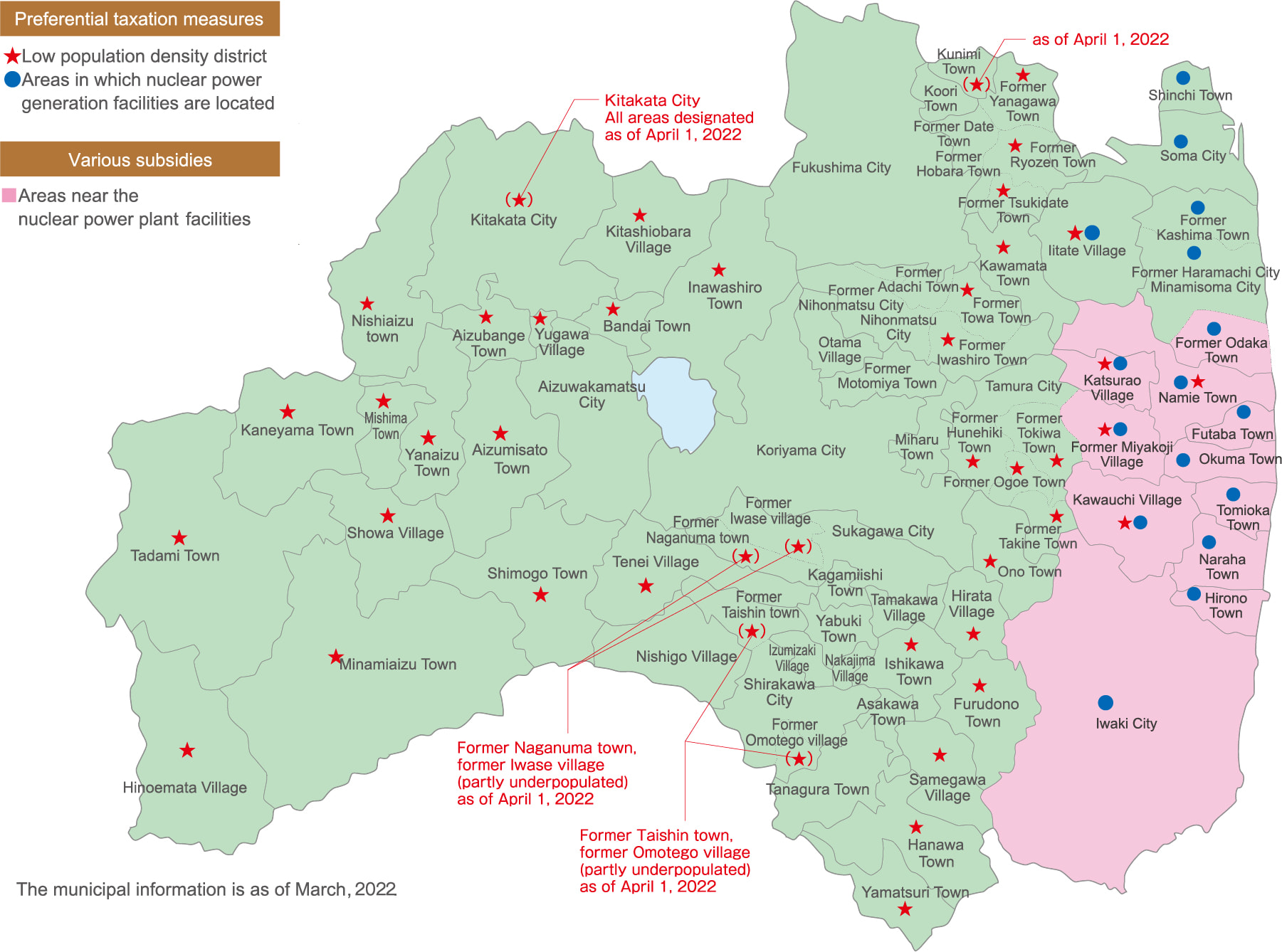

※2 Iwaki, Soma, Tamura, Minamisoma, Kawamata, Hirono, Naraha, Tomioka, Kawauchi, Okuma, Futaba, Namie, Katsurao, Shinchi, Iitate (as of March 2022)

※3Covered cities, towns, and villages: Part of Minamisoma City, Kawamata Town, Naraha Town, Tomioka Town, Kawauchi Village, Okuma Town, Futaba Town, Namie Town, Katsurao Village, litate Village (as of March2021)

※4 Applicable municipalities are sections of the following: Iwaki, Soma, Tamura, Minamisoma, Kawamata, Hirono, Naraha, Tomioka, Kawauchi, Okuma, Futaba, Namie, Katsurao, Shinchi, and Iitate (as of March 2022)

For more information, please contact below.

◎For further information, please contact the Local Promotion Bureau, Prefectural Tax Department.

INDEXAdvantage

03Japan’s Top-level Financial support

- (National system)Independence & recovery support employment creation business siting subsidy

- (National system) Tsunami & nuclear disaster area employment creation business siting subsidy

- Fukushima industry enhancement company siting promotion subsidy

- Regional revitalization implementation and development promotion cost subsidy

- Subsidy to encourage transfer of head office functions to Fukushima Prefecture

- ICT office location promotion project cost subsidy (Operation costs/Initial costs assistance)

- Subsidy for companies locating in the vicinity of Fukushima Prefecture's nuclear power facilities (F subsidy)

- Exemption for taxation based on the Act on Special Measures for the Reconstruction and Revitalization of Fukushima (tax benefit)

- Special tax regulations according to the "Fukushima Special Zone for Promoting the Investment in the Reconstruction of Industry" (tax benefits)

- Tax system for strengthening regional bases (tax benefits)

- Tax incentives faor prefectural taxes

05Features of each district